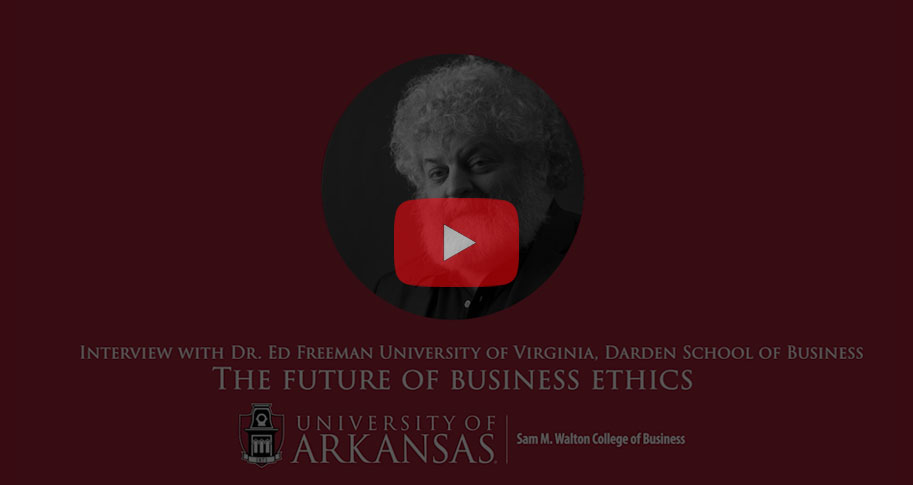

We have the immense pleasure of having Ed Freeman, university professor and academic director of the Institute for Business in Society at the University of Virginia Darden School of Business. As the author and editor of over 30 volumes and 150 articles in the areas of stakeholder management, business strategy, and business ethics, Freeman is a true luminary in his field.

Most recently, Freeman is known for his new book The Power of And, and his new documentary, Fishing with Dynamite, available on iTunes.

Join us as Cindy Moehring Moehring and Ed Freeman discuss the stakeholder theory, Freeman's contributions to the field of business ethics, and where the future of business ethics education is heading.

Podcast:

Episode Transcript:

[music]

00:12 Cindy Moehring: Hi, everybody. I have the distinct pleasure of having with me today, Ed Freeman. Hi Ed, how are you?

00:19 Ed Freeman: Hi Cindy Moehring.

00:21 Cindy Moehring: It's good to see you. Ed is the university professor and Olsson Professor of Business Administration and an academic director of the Institute for Business and Society at the University of Virginia at the Darden School of Business. And prior to going to Darden, Ed also taught at the University of Minnesota and also at the Wharton School at the University of Pennsylvania. Ed may be well known to many of you, that Ed is the co-author of a new book that just came out called The Power of And: Responsible Business without Trade-Offs, that just came out in June of 2020. He has also just put out a new documentary that's available on iTunes called Fishing with Dynamite. So I would encourage you to explore that as well. We'll put the information in the show notes at the end. Ed has written a number of other books as well. He has... Also the author and editor of over 30 volumes and 150 articles in the area of stakeholder management, business strategy, and business ethics. Ed is best known for an award-winning book called Strategic Management: A Stakeholder Approach. That one was originally published in 1984.

01:26 Cindy Moehring: It has been widely cited since then, and it's a book where Ed traces the origins of the stakeholder idea to a number of others and suggests that businesses build their strategy around their relationships with key stakeholders and not just the shareholders. We're actually gonna get into that a bit more in the podcast. But first, let me just say thank you so, so much Ed for being here today. We are super excited to have you share with us your thoughts on the topic of business ethics, and really what the future holds for the entire area as well as for the education of business ethics, and I am excited for the audience to get to hear from you on that.

02:11 Ed Freeman: I'm a real fan of the Walton School. I spent a little time there a few years ago as the ethics program was getting started. So it's great to maybe virtually get to know some of your students.

02:28 Cindy Moehring: Yeah. Well, thank you for that help a couple of years ago, and I know some of our professors are big fans of yours as well. Dan Worrell and Jennifer Kish Gephart and those are probably the folks that you had the opportunity to meet with.

02:39 Ed Freeman: Yep. That's right.

02:41 Cindy Moehring: They're fantastic, yeah. And they're on my academic advisory board. So I feel real fortunate to be able to get to work with all of you. Share with us, Ed, what do you think are some of the main advancements that have occurred in the field of business ethics and government and risk management that you've seen in the last, I don't know, 15, 20 years.

03:04 Ed Freeman: Well, I could say that when I wrote my stakeholder book and it was published in '84, I think I can safely say no one cared. I don't think many people... Well, I know not many people read it. For all the citations it has now, there were only 2000 copies printed and we gave most of those away. So when the number of citations outstrips the number of copies, you're pretty sure people haven't read what you've done, and not many people seemed to care very much about it. That's a far cry from today. I get an email this morning from JUST Capital talking about the business roundtable statement, what the 181 companies have done, what they've done especially with respect to the COVID and Black Lives Matter crises, how they performed, and what people expect. Those things just simply wouldn't have existed. Back in the day when you said you taught business ethics, you got a lot more laughter and snickering than you would today. Whereas I think today, every business school knows it has to do something with ethics. A lot of them don't know what yet, but that's... And every business knows. Business people know that you can't separate the business part from the ethics, business people that are successful all the time.

04:52 Cindy Moehring: Yeah, yeah.

04:53 Ed Freeman: So I think the acceptance that, "yeah, of course, we gotta work this out," is much, much greater than it was much earlier, at least in my opinion.

05:09 Cindy Moehring: So what do you think the tipping point was? You mentioned in '84, nobody was interested. People would laugh... What was the tipping point? Because it is so different today, and I agree with you on that.

05:23 Ed Freeman: Yeah. Well, it's hard to say. In this new book, we try to argue that there's... That the global financial crisis in 2008 to 2009 created sort of a perfect storm, which things have been adding to. We haven't really figured out how to deal with the inequality that both caused and was a result of the global financial crisis. And people have been questioning, given that inequality has increased so much between the top and the bottom in society since roughly the late 1970s, and you can show that the curves just really depart rather than move together. We haven't really figured that out, and the calls for reform of capitalism have become more... Have become louder and louder. So I think today, if you look at the results of the financial crisis, and again, it was 10 years ago, and COVID and the racial inequality movement and global warming, you have a perfect storm that says business...

06:52 Ed Freeman: If we're gonna solve these crises which threaten the very foundations of our society, business has to be involved in that. And the way business has to be involved in it is not just giving money to charity, but they have to look at their business models, say, "What's our purpose? Who are our stakeholders? How are we creating value for our stakeholders? And can we create value that makes society better off, but also makes our customers and suppliers and employees and our shareholders better off?" That's hard to do. But I think those are the right questions to ask today.

07:34 Ed Freeman: Yeah. I think you're right about that. So let's jump to that Business Roundtable statement because we're... Interestingly, we're at the one-year anniversary of it right now. It was one year ago, almost to this day, that it came out. You must be happy to have seen that because it aligns so well with your stakeholder theory and in what you were saying back in '80, '84. What were your thoughts when you saw it come out and did you have any role in influencing it?

08:05 Ed Freeman: Look, we had... For 10 years, we had the Business Roundtable Institute for corporate ethics at Darden, and that had sort of withered away for a variety of reasons. And so I had worked with the roundtable fairly closely in the past, but I really had nothing to do with the statement. So I was surprised, very surprised, very happily surprised. I think my fist was pumping in the air. So I was very happy that they came around to it. I didn't need to have a personal part in it. If you look at that, if you look at the Davos statement, if you look at other things like that, the Larry Fink letter to the CEOs he invested in BlackRock. If you look at the emergence of principles for responsible investment, which are some principles that essentially reaffirm the stakeholder view or at least the ESG variation of that, environment, society and governance. And you look at the folks who are doing conscious capitalism or inclusive capitalism or impact investing, etcetera, what you have is a ground swell that says, "Hey, there's a better way to do business. In other words, there's a new narrative." This new narrative says in part, "Yeah, you've gotta pay attention to stakeholders as well as shareholders... "

09:49 Ed Freeman: Look, businesses have to make money. Profits are important. It's just not the only thing, and it's the equivalent. The shareholder primacy view, the Milton Friedman profits are the only thing that matter, would be like saying, "Hey, I need a red blood cells to live. So the purpose of life is to make red blood cells." And that's just a logic mistake. But the left often demonizes profits, and that's an equal mistake. People have to get paid. And so in The Power of And, what we do is we say, "Look, it's about stakeholders and shareholders. It's about purpose and profits." And by the way, one of my favorite high-purpose companies, and for the most part, high-profit companies in its history is WalMart. Walmart's always been a high purpose kind of company. I grew up poor and Walmart, at least Sam Walton's Walmart, helped my parents be able to afford things that they couldn't. So it's purpose and profits. It's stakeholders and shareholders. It's business set in society and in markets. It's seeing people as fully human as well as economic beings. And it's business and ethics. And the "And" says, We gotta put those things together. So I think the tipping point... There's no going back to only shareholders count.

11:30 Cindy Moehring: If you take care of all of the stakeholders, you are looking out for the long-term view of the shareholders and for the company to be able to be sustainable for the long-term.

11:44 Ed Freeman: Yeah. Well, as I've gotten older, I've become increasingly distrustful of the long term, of what do you wanna do in 10 years? My answer is to be breathing. [laughter] So I like to think that, yes, you're right, but it's also the... You do better in the short-term. Look, you can always take shortcuts, right? But if you see the purpose of a business, help people live better, then you gotta figure out how to do that today. You can't say, "Well, in the long-term that'll work itself out." Well, yeah, here's how you have a great long-term: Have a great short-term and keep it up. But what most people do, and I've heard for 40 years, "Well, this ethic stuff counts, but not in the short-term, in the long-term." Well, we move here, the long term keeps moving. And so the short-term/long-term distinction is oftentimes an excuse for not doing the stuff you need to do now.

12:51 Cindy Moehring: Now. Yeah. You're right. That's...

12:54 Ed Freeman: After the global financial crisis, my finance faculty friends said, "Well, of course, look, nobody said, maximize shareholder value in the short term. We meant maximize value in the long term." And I said, "Well, look, I'm not really a philosophical positivist, but you guys are. And the only observable way you observe shareholder values is in a short term. The other way to say it is, "Life exists in the now, it exists in the short-term, and if you can't figure out how to do it in the short-term, there's no reason to believe the long-term is gonna magically take care of itself." So A, I think you're right, but I wanna make a stronger claim that you have to figure out how to put these things together in the short-term. And that requires not only business sense, but it requires creative imagination.

13:58 Cindy Moehring: Yeah, it does. To build for the long-term now, and do it in the short-term. It's all building blocks building up to the end. That's a great reframing and a great way to think about that. That's really powerful. So it feels to me that we have arrived at this new place. As you said, it's hard to pinpoint maybe exactly what the tipping point was, but well there's no going back, and we've arrived at this new point in terms of thinking about what the purpose of a corporation is. Do you think in some ways, Ed, that the European view of ESG and sustainability and CSR was ahead of the US, and in any way helped set the stage for where we are now?

14:47 Ed Freeman: They mostly saw the stakeholder idea as a way to understand civil society. And the civil society, that the issue has to be, it's gotta be about the business model, not about CSR. And so this has to be integrated into the business model.

15:08 Cindy Moehring: And the strategy.

15:11 Ed Freeman: And the strategy. Look, I think people talk about what's the business case, and I say, "Look, the business case depends on what you stand for, what your purpose is, who your stakeholders are, and how you're trying to create value for them." That's the business case. It's not just about, "Is it gonna make money or not?" That's not really very interesting. So putting these things together is hard. I think there's less an American model and a European model, and it really varies by company. For instance, Novo Nordisk in Denmark has been doing this for a long time. Danone in France. I always put Walmart as one of the top American companies that was stakeholder-oriented. So I think it depends less on the country. Though some laws make it easier, some country laws make it easier.

16:15 Ed Freeman: But even in the US, there's nothing in any of the state chartering laws that say you can't figure out how to create value for all your stakeholders. The idea that shareholders own companies is just a myth. And having said that, I'm a big proponent of making as much money as you can for shareholders. It might sound contradictory, but how are you gonna do it? You're gonna have great products, you're gonna have suppliers who wanna make you better, you're gonna have employees who show up every day with more than just to get a check, you're gonna have... Be a good citizen in the community, so communities don't think you ruined Main Street. And if you do those things and you get a little lucky, you might make money. So I don't see the big... I've always thought the stakeholder idea was the simplest idea in the world. It was just about how business works, and I think it's being recognized more that, "Yeah, this is how business works and how it works well."

17:22 Cindy Moehring: So what do you think about the idea of the B Corp or the benefits corp? Where does that fit into your thoughts about the on the stakeholder theory?

17:31 Ed Freeman: Even though I think you don't have to do this, it's a way of formally saying, "Hey, purpose is important. It's purpose and profits. They explicitly say that. The problem can be... It's the same with a problem with non-profits. People who work in the non-profit world have high purpose, and they think they don't have to pay much attention to things like budgets and funding and that sort of stuff. And people in the for-profit world, in the old story, think it's just about budgets and profits and the money. In both cases, it's about both. In a non-profit world, again, everybody's gotta get paid, you have to have at least enough money to figure out how... What you're gonna invest in in the future. What B corps do is it's a purpose and profits.

18:37 Ed Freeman: Now, I didn't think we needed them for a long time. And then a company I know reasonably well, Whole Foods, got attacked in the capital markets, and Whole Foods ended up selling to Amazon. I think the capital markets, in this case, the private equity firm or the hedge fund that was attacking them simply discounted all of the stakeholder-oriented things that Whole Foods does that's central to their business model, and they can't exist without those things. It's one of the sources of profits. And so if they'd been a B corp, no problem. Because they weren't and no one held a majority of the shares, then they ended up having to find a white knight. So I think the way we regulate capital markets might need to change. Maybe we need something like a rule.

19:54 Ed Freeman: You have to hold the shares for a certain amount of time before you can vote. I think B corps can be a good thing, as long as they don't take people's minds off... Look, if you're serious about a purpose, every penny is important. Every penny is important because it lets you pursue that purpose.

20:22 Cindy Moehring: So now that we've arrived at this, let's say, new place, the stakeholder view, what do you think the future is gonna look like?

20:39 Ed Freeman: Well, we have some serious problems we have to deal with. All these problems are multi-institutional. We have to figure out what's a better connection between business and government. Some of the most value ever created or facilitated by the government was the Surgeon General's Report on Smoking and Health. It created an enormous amount of value. People lived longer lives, they worked work longer, they lived live more fruitful lives. The companies themselves, the tobacco companies, whatever you think about them, managed to survive and go along and innovate.

21:26 Ed Freeman: Civil rights legislation creates an enormous amount of value. It opens up a whole host of people who've been shut out, etcetera. I think the government needs to take this facilitating value creation seriously and help create what I would call a nation of entrepreneurs. What we need is many, many more people starting and trying to build businesses, and I say this, especially with people who have been shut out of the system. I worked with a man named Jeff Cherry, who's the CEO of something called Conscious Venture Network or Conscious Venture Labs. And we worked work with people in this case from West Baltimore to try to start companies that might be the next Whole Foods, etcetera.

22:34 Ed Freeman: These were, for the most part, entrepreneurs who grew up in tough circumstances, who were shut out of a lot of ways to try. We need to become a nation of entrepreneurs. Business can't do that alone. Ethics and business ethics is a classic example of this, Cindy Moehring. If I say to any group, "Look, we have a real ethics issue in this business," not a single person thinks, "Oh, somebody must have must've invented something that'll make our lives better." But bringing good into the world is just as important as preventing bad things and we don't often think about that.

23:26 Cindy Moehring: Yeah. That's a good point. Well, speaking about entrepreneurship and building a nation of entrepreneurs, you are certainly speaking to the heart of Walton College. We have a very strong focus on entrepreneurship and filling that out. In fact, there's a whole new department called SEVI now that's focused on entrepreneurship and venture innovation. So that's exciting to see. So Ed, this has been a great conversation. Let me ask you a couple more questions, bringing it back to the education point of view in and universities. What do you think that universities should be doing differently to better prepare our students to become the future business leaders of the world?

24:17 Ed Freeman: Well, I think we have to broaden the set of disciplines that's relevant for business leaders. I've taught at my college and I have taught really sort of the humanities part of the EMBA. We do courses in literature, in theater, I've done one in music, and all of these help to build a creative imagination. We're good at teaching people what the language of business is and how to conduct yourself, and those kinds of things. We're lousy at teaching the more critical perspective, and we're even lousier at teaching the more creative perspective. Our take here is, if you see something you don't like, to critique it. You critique it by creating something better. And I think also, this means a change in the way we teach. Look, I love to teach case studies, they're great. I love even more to teach Socratically. That is trying to make the student the center of the classroom and start where they are. We tend to like to teach jointly. So we'll teach together with people in finance and strategy and quantitative analysis and those kinds of things. Because it's not just about ethics, it's about trying to understand what this new narrative is throughout the disciplines of business.

26:11 Cindy Moehring: Right, right. So if you... Those were great points. So if you had to maybe sum it up in three words or three phrases about the most important aspect of preparing our students going forward, what would they be?

26:25 Ed Freeman: Well, I would probably say we need to teach some purpose and profits, stakeholders and shareholders, and people are human beings as well as economic agents. The other two things are important, but if we get those three things right, I think we'll go a long way towards creating a generation of business leaders that are gonna make business better. And that's where the bar ought to be, we ought to say to our students, "Your job isn't just to learn how to run a profitable business. Your job is to figure out how to run a profitable business, sure, that does something that makes the world better." And if we have thousands of people doing that, hey, they won't all work, but society will flourish in my view.

27:24 Cindy Moehring: Yeah. And from your earlier comments, it sounds like if we can at universities do that creatively and do that in an integrative way with experiential learning, then that will really be how those ideas come to life for them.

27:40 Ed Freeman: People need to find their voice. And there are lots of ways to do that.

27:45 Cindy Moehring: Yeah, yeah. Well, this has been fabulous. Let me end on a fun question or two for you. Do you have any...

27:53 Ed Freeman: Okay. Sure.

27:55 Cindy Moehring: Yeah. Do you you have any good recommendations of either fun books or movies or series or podcasts that you have enjoyed watching while we've all been inside during COVID that you'd recommend?

28:08 Ed Freeman: TV. TV is in a golden age now. They're just so good. I've been watching on Netflix Money Heist, which I think there are four seasons. It's Spanish, but it's dubbed. But it's dubbed with real voice actors. It's not... You can't really tell it's dubbed.

28:30 Cindy Moehring: Oh, that's cool.

28:31 Ed Freeman: And it's really terrific. A large group of people get together and take over the Mint in Madrid, and they're actually printing... They're trying to print $2.4 billion dollars. And it's really terrific because all the characters, even the bad guys have redeeming features. And so it's a very human story.

29:03 Cindy Moehring: Well, Ed, thank you so much for your time. Thanks for being a guest with us today. This has been a illuminating conversation, and I just thank you so much for your time.

29:12 Ed Freeman: Thanks Cindy Moehring. Thanks very much for having me.

29:14 Cindy Moehring: Absolutely. Bye bye.

[music]