Delivering Decisions: Response to Trends in Domestic Freight Transportation

August 5, 2019 | By Mathew Waller

The freight transportation industry never sits idle. It has a history of morphing into a newer version of itself, and the winners of yesterday and today become the losers of tomorrow if they fail to re-invent themselves to keep up with the changing times. Or change the times themselves.

Moving freight is big business. Transparency Market Research published a report in 2016 that estimated revenues of $8.18 trillion for the global logistics market and predicted that number would climb to $15.5 trillion by 2023. Plunket Analytics, meanwhile, estimates the U.S. freight transportation industry at $1 trillion.

It is also a complex industry. The supply chain involves a wide range of business activities – transportation, customer service, inventory management, order processing, payments, warehousing, packaging, purchasing, and maintenance, to name few. It carries products over roads, on the rail, on waterways, and through the air. Also, shipments can be as large as a container filled with big-screen televisions traveling to a distribution center or as small as a single hand-held tablet computer.

So, what’s the next metamorphosis for this heavy industry?

The late Peter Drucker might have summed it best when he wrote, “The only thing we know about the future is that it is going to be different.”[1]

Defining what “different” will look like in the years to come is an inexact science. There’s value, however, in thought leadership that helps shape the future in light of what we know today. So, the Sam M. Walton College of Business convened a group of leaders to discuss the implications of significant trends affecting the freight transportation industry. The 11 participants included top executives from Fortune 500 retail, food, freight, and logistics companies, as well as business professors, a venture capitalist specializing supply chain, a transportation security analyst from a top investment bank, and a world-renowned producer of economics media.

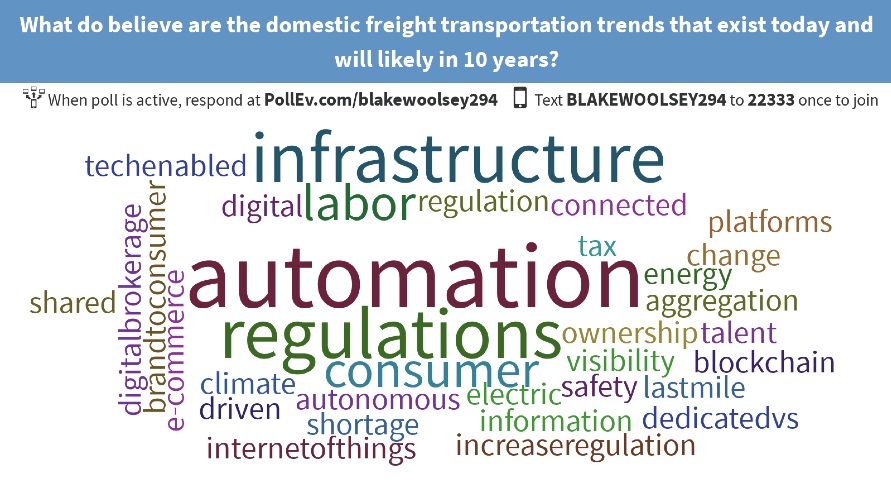

Rather than attempting to forecast the future, the group used a fast-paced guided discussion to produce powerful insights regarding what leaders should do today about the most significant trends in the freight transportation industry. The process focused on existing and emerging trends that will likely still be part of the business in 10 years. Working in two groups of five or six each and then as a large group, the participants identified more than a dozen factors affecting the industry. The first brainstorm was done electronically, with all the participants sharing their ideas via text. The results are in the word cloud graphic (Figure 1.0).

Figure 1.0: What do you believe are the trends that will affect domestic freight transportation that exists today and will likely in 10 years?

Next, the participants split into two groups to discuss and chart their top trends. From that list, they prioritized the top three, landing on automation, regulation, and e-commerce/final mile.

One of the participants summarized the findings by pointing out the thread that pulls them together: These trends are driven by consumers (e-commerce) and resulting in innovations (automation) that are impacted by regulations. Leaders, therefore, are challenged to drive automation that meets consumer demand, while also influencing consumers’ views about the tradeoffs that come with rules.

E-Commerce/Final Mile

If you order a riding lawn mower from the website of your favorite big-box home-and-garden retailer, you no longer need to figure out how to pick it up at the store and get it safely to your garage. Within a week or so of placing your order, a truck will wind its way into your neighborhood, park in front of your house, and the driver will unload a pallet with your mower. Soon you can be happily clipping your Bermuda.

If you order a pizza online, someone will quickly bring it to your door, which is nothing new. However, the day is coming and has come in some countries, where a driverless car or drone might deliver it.

E-commerce retail sales in the United States were a robust $390.5 billion in 2016, according to statista.com, but that number had climbed to more than $500 billion in 2018 and forecasters were predicting it to reach $700.5 billion by 2022. In China, almost a fifth of all retail sales happened over the internet in 2016, compared to 8.1 percent in the United States. The UK, South Korea, and Denmark also ranked ahead of the United States in retail e-commerce share.

Technology will play a huge role in e-commerce deliveries. Drone activity in the U.S., for instance, has grown from $40 million in 2012 to $1 billion in 2017, according to research by McKinsey. Also, the company estimates corporate and consumer applications for drones will have an annual impact of $31 billion to $46 billion on America’s GDP by 2026.

Freight transportation companies, of course, play a key role by shipping products to consumers – everything from fuzzy slippers to a 400-pound gun safe. The retailers might be mega-corporations like Amazon or Walmart, but they also might be operated from someone’s garage or located in a small shop in a strip mall. Some retailers also handle some or all of the delivery; others outsource it.

In response to this growing business segment, our panelists suggest several critical actions for leaders in the industry. For instance, companies will need to invest in advanced analytics capabilities to help manage the logistics for final mile delivery. They also will need a greater openness to operate in shared networks, which could include a willingness to link with competitors to move shipments. Leaders also will need to build consumer trust with creative ways to securely verify the delivery of products at homes. And they will need to look for ways to efficiently deliver products to the places that are convenient for consumers, such as their workplaces.

“It can take a lot of shapes and fashions to meet customers where they want to be met,” one participant said. “You have to find an efficient way to get to market and understand who can get you there. Some of this will require a different way of thinking about who you are in business with. It may be a competitor. It could involve some non-classical agreements.”

Automation

To meet the burgeoning consumer demand for fast, secure deliveries, the freight industry is investing heavily in automation. Discussion on automation in the transportation industry typically involve things like drones and autonomous driving vehicles, and our panelists agreed that these technologies could address driver shortages and reducing carbon footprints.

For now, some of the more consumer-facing efforts at automation – driverless vehicles, drones, robots delivering packages, etc. – are struggling to keep pace with consumer demands, especially on final-mile deliveries. However, efforts are ongoing to break through, and significant strides are occurring almost daily in automating deliveries.

Panelists also took a broader view of the topic. For them, automation needs to happen “from ramp to ramp” – and beyond the ramp, as well. Companies need to invest in workflow automation in the back office, as well as on the docks and roads and increase their ability to analyze data and produce business insights. This will likely require a willingness to work with experts outside of the transportation industry and an openness to experimenting with innovative processes with new technologies such as blockchain.

“Everyone has lots of data,” one panelist noted. “We’re just not doing as much with our data as we should be.”

Regulation

Freight moves over land, water, and through the skies, and the government always plays a critical role in shaping the future of how goods move across such public spaces. Laws, policies, and guidelines about who can do what and how opens doors wide for some companies and slam them shut for others.

Our panelists believe it is in the best interests of the industry to operate safely and in ways that most benefit consumers. Anything that harms the consumer, they said, ultimately is bad for business. Companies have every reason to “do the right thing” for consumers and society, they would argue, and there’s plenty of evidence to support that position.

An overabundance of government regulations drives up costs for companies and the consumer. There was a concern that more and more consumers lack trust in the systems and might push for more stringent regulations in transportation. Panelists agreed that companies in the freight transportation industry should be proactive to educate consumers and legislators, with an emphasis on consumers.

The industry needs to approach regulation from a macro level that educates and influences the opinions of voters who elect the politicians who establish regulations. This influence with consumers, as much or more so than more direct lobbying of government bodies, will push politicians and bureaucrats to create responsible rules that benefit consumers and business alike and to deregulate or resist regulation when it harms the economy and public good.

“If you want to win the battles on regulations ten years from now,” one participant said, “you have to start reaching the street right now through every possible communication method you can use to get the average person to understand … what a tradeoff means on their terms.”

Challenges

The challenges facing the freight transportation industry are daunting, but our panelists viewed them as invigorating. These leaders have invested much of their career in solving issues facing the industry and, in doing so, helping to take it to a better place. They gave every indication that they – and, therefore, the organizations they represent – will do the same as it concerns e-commerce/final mile, automation, regulation and any other trend in their industry.

[1]Peter F. Drucker, Management: Tasks, Responsibilities, Practices, New York: Harper & Row, 1973. P.44