Sit-Down & Fast-Food Restaurants in Arkansas During COVID-19

February 25, 2021 | By David Sorto

A Report from the Center for Business and Economic Research.

COVID-19 continues to present challenges for families, governments and businesses. The pandemic has disrupted everyday life and has prompted safety directives from the state in the interest of public health.

A review of the available sales tax revenue data for sit-down and fast-restaurants across Arkansas provides a detailed look of how two large sub-sectors in the same industry have adapted during COVID and its subsequent disruptions.

Facing the Same Restrictions

The pandemic has placed varying degrees of restrictions on businesses and the restaurant sectors have experienced these dynamics firsthand. At the start of the pandemic in Arkansas, restaurants could only operate by carryout, curbside pickup or delivery. The Phase 1 guidelines saw dine-in services return at a one-third capacity in early May and increase to two-thirds capacity in mid-June. Sit-down and fast-food restaurants have both been impacted by COVID, although their severity and timing has been different as observed from their sales tax revenues.

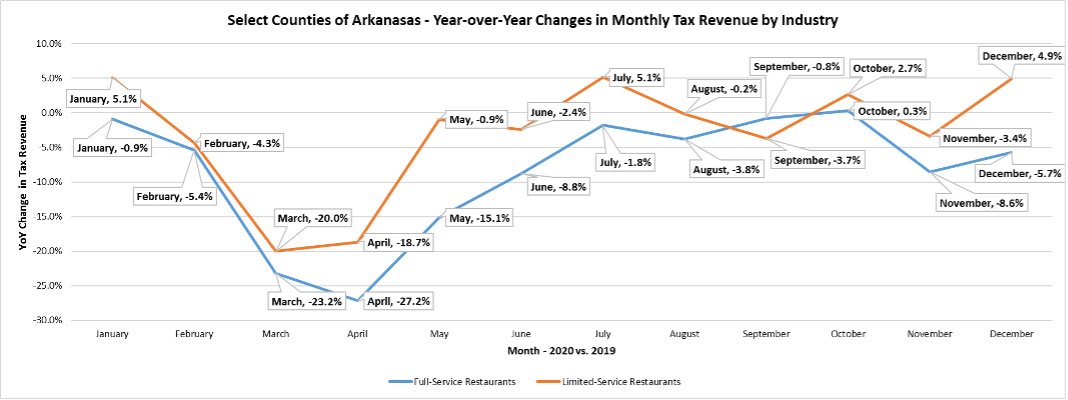

Sit-down and fast-food restaurants have experienced declines of 10.2% and 4.8% in sales tax revenue, respectively, during the pandemic (March-December). The harshest declines came early into the pandemic as sit-down restaurants experienced sales tax revenue declines of 23.2% in March and 27.2% in April. Fast-food restaurants experienced sales tax revenue declines of 20.0% and 18.6% in the same months, respectively. The following months of the pandemic have had differing results for sit-down and fast-food restaurants.

Fast-food restaurants were able to recover quickly as both May and June saw only low single-digit declines in sales tax revenue. By July, fast-food restaurants had experienced a strong increase in sales tax revenue. Sit-down restaurants did not see low single-digit declines in tax revenue until July and only the month of October saw a slightly increase in sales tax revenue.

The different paths during COVID for sit-down and fast-food restaurants are likely rooted in the nature of each these sub-sectors. Fast food restaurants are oriented to quick service and a large portion of their business revolves around carryout, curbside pickup or delivery and as such are perceived as having lower risk during a pandemic. Sit-down restaurants, on the other hand, cater to a prolonged in-restaurant experience and therefore comes with higher risks during a pandemic.

Enlarge "Select counties of Arkansas - Year over year changes in monthly tax revenue by industry" graph.

Regional Trends

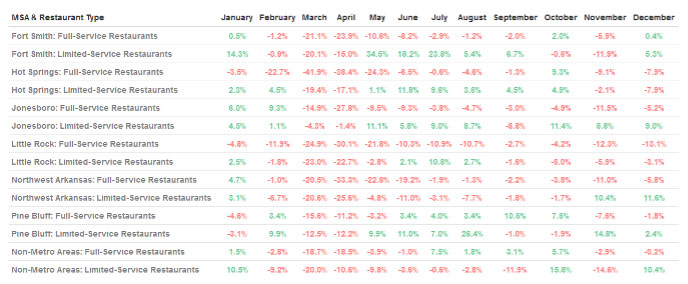

The different regions of Arkansas have shown distinct regional trends as the pandemic has progressed. The declines in sales tax revenue among sit-down and fast-food restaurants were seen in all regions in March and April. Since May, the metro areas of Fort Smith, Hot Springs, Jonesboro and Pine Bluff have seen growth among their fast food restaurants’ sales tax revenues while the revenue losses at their sit-down restaurants have somewhat improved.

The non-metro areas have seen an inverse trend to the state-wide pattern. Among non-metro areas, sit-down restaurants have shown signs of sales tax revenue growth since July while fast-food restaurants have seen fluctuations in their revenues.

Sit-down restaurants in Central Arkansas have struggled with double-digit declines in sales tax revenue through the pandemic; with some improvements in September before weak holiday business in November and December. Sales tax revenue among fast-food restaurants in Central Arkansas grew from June to August but saw single-digit declines from September to December.

Restaurants in Northwest Arkansas have also struggled during this time period. Sit-down restaurants have seen consistent declines in sales tax revenue during the pandemic. Revenues improved some between July and October but once again saw weak holiday business in November and December. The region’s fast-food restaurants did not have the sales tax revenue growth between May and August like other parts of the state, as they saw mostly mild single-digits tax revenue declines from May to October. Fast-food in Northwest Arkansas did experience strong double-digit growth in sales tax revenue over both November and December.

Year-over-Year Changes (%) in Sales Tax Revenue

Enlarge "Year-over-Year Changes (%) in Sales Tax Revenue" chart.

The Path Ahead

Restaurants are important social and cultural institutions that also drive economic activity and employ many residents. COVID-19 has presented numerous challenges to individuals in this sector. Some funds have been made available to small businesses, such as restaurants, in the latter part of 2020. The state of Arkansas awarded $48 million in grants to help 2,136 businesses who were impacted by COVID and filed applications in November. The December 2020 COVID-19 Relief Bill had outlined new assistance for restaurants and other small businesses, specifically the $284 billion allocated to fund another round of forgivable Paycheck Protect Program loans. In addition, the “American Rescue Plan” just passed in March 2021 would allocated $28.6 billion in grants to restaurants with reduced revenues in 2020 due to the pandemic.

However, these funds alone may not be enough to ensure the survival of restaurants in Arkansas. Nationally, restaurant sales were $240 billion lower in 2020 than pre-pandemic projections. As seen in the sales tax revenue patterns, many restaurant operators in Arkansas have been hit by strong declines in business. Overall, it appears that the sector is showing signs of recovery, but it is certain that many restaurants are still dealing with accumulated fixed costs such as rent. The congressional assistance is essential as these businesses will continue to deal with recovering revenues and increasing costs, largely associated with safety and protective equipment.

The distribution of COVID vaccines will over time increase public confidence in the safety of returning to restaurants, but restaurants need continued immediate support to ensure their survival.

A Quick Review of COVID and the Business Environment

The tax data provide us with the information to compare how COVID has impacted two different subindustries within the restaurant sector. The first presumptive case of COVID in Arkansas was seen in Pine Bluff on March 11, 2020. As confirmed cases rose in the following week, Gov. Asa Hutchinson acted to close public schools and limit restaurants and bars to carryout, curbside pickup or delivery. The Arkansas Alcoholic Beverage Control adopted an emergency rule to allow the sale of alcoholic beverages with outbound food orders. Regardless, the measures left many businesses to pivot to the new realities of COVID in a short period.

As COVID numbers initially began to decline in late April, the governor announced plans to begin re-opening sectors of the economy. Phase 1 guidelines would allow restaurants to provide dine-in services at one-third capacity if certain safety conditions were enforced; however, bar-areas of restaurants and bars were not allowed to re-open under the plan. The restrictions forced many restaurants, bars and breweries to pivot in order to survive.

Late May brought guidelines for bars to reopen at two-thirds capacity while restaurants would be allowed to expand to two-thirds of their dine-in capacity. The implementation of open container zones have been an option utilized by several Arkansas cities during the pandemic. In 2019, the Arkansas Legislature passed Act 812 which allows cities to create zones permitting open containers of alcohol. Open-drink zones were adopted by the cities of Mountain Home, El Dorado and Little Rock during July and August 2019. The cities of Fayetteville, Springdale and Fort Smith have adopted these zones to aid restaurants and bars in ensuring social distancing guidelines.

The persistence of COVID-19 resulted in the governor enacting an 11 p.m. curfew for businesses that sell or serve alcohol on their premises. The directive came into effect on Nov. 20, 2020, was extended on Dec. 31, 2020 and expired on Feb. 3, 2021. On Feb. 26, 2021, the directives on restaurant dine-in operations were converted to guidance, which encourages previous safety measures but places enforcement at the discretion of restaurant operators.

The Data

The Arkansas Department of Finance and Administration (DFA) provides a monthly tax report available by city/county and industry. The industry-specific reports are behind by two reporting periods (i.e., a March 2020 report will show tax collection for January 2020). The reports serve as a proxy about the general economic and business environment of a city/county and its industries. If tax revenue is up then this suggests a region and/or industry is experiencing growth. The detailed nature of these reports provided a manner to do cross comparisons.

Monthly tax revenue data, by NAICS industry, was retrieved from the Arkansas DFA for the period January 2019 to December 2020. The businesses of focus are sit-down restaurants (NAICS 7221 – Full-Service Restaurants) and fast-food restaurants (NAICS 7222 - Limited-Service Eating Places). Sit-down restaurants are defined as establishments providing food services to patrons who order and are served while seated. Fast-food restaurants are defined as establishments providing food services where patrons generally order or select items and pay before eating.

Tax revenue data, as defined by the specific NAICS industry codes of interest, for 2019 and 2020 was available for 68 counties for sit-down restaurants and 37 counties for fast-food restaurants. Data was available for all six metropolitan statistical areas (MSA) contained within Arkansas. The metropolitan areas are defined as the following: Fort Smith (Crawford, Franklin and Sebastian counties), Hot Springs (Garland), Jonesboro (Craighead and Poinsett), Little Rock (Faulkner, Grant, Lonoke, Pulaski and Saline), Northwest Arkansas (Benton, Madison and Washington), and Pine Bluff (Jefferson and Lincoln). Non-metro areas refer to the counties with data that do not comprise MSAs listed above. The following MSAs for fast-food restaurants have more limited definitions: Fort Smith (Crawford and Sebastian), Little Rock (Faulkner, Lonoke, Pulaski and Saline) and Pine Bluff (Jefferson).