A Tale of Two Businesses: Arkansas’ Bars and Liquor Stores during COVID-19

February 3, 2021 | By David Sorto

A Report from the Center for Business and Economic Research.

This report expands on information first delivered at the 2021 Arkansas Business Forecast.

COVID-19 has presented numerous struggles – mental, social, physical and/or financial – for everyone. However, while some businesses have recovered from the initial disruption of the pandemic, others continue to experience dramatic losses.

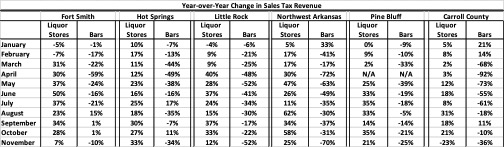

A review of the available tax revenue data at bars and liquor stores in Fort Smith (Sebastian), Hot Springs (Garland), Little Rock (Pulaski), Northwest Arkansas (Benton, Washington), Pine Bluff (Jefferson) and Carroll County in Arkansas provides an example of how two businesses which offer a similar consumer product have had mirror opposite outcomes during COVID.

Two Businesses, Two Different Directions

Without accounting for ambience and the social aspects of gatherings, bars and liquor stores provide similar products to consumers; however, these two businesses have experienced drastically different business outcomes during the COVID-19 pandemic.

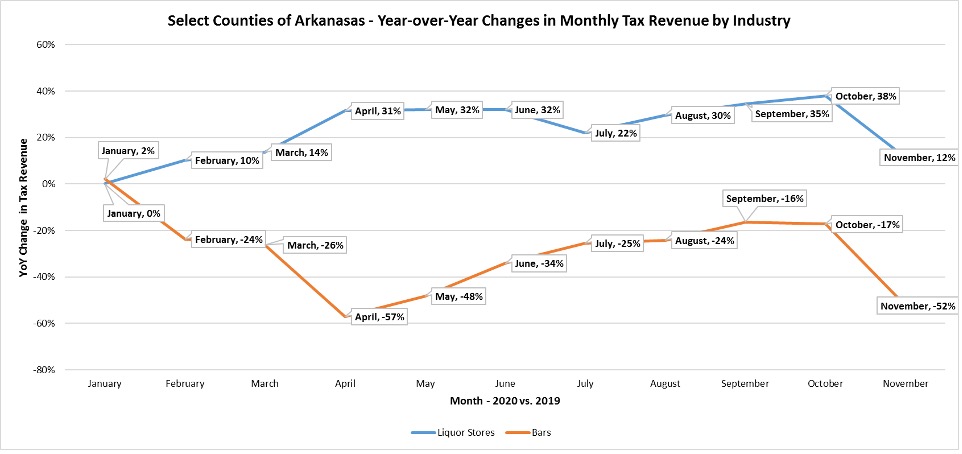

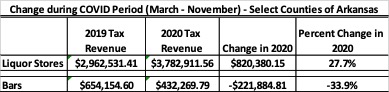

Liquor stores sales have experienced phenomenal growth as seen through their strong tax revenue growth on a year-over-year basis during the pandemic. Bars, on the other hand, have struggled as their sales have declined drastically on a year-over-year basis during the same time. Between March and November, sales tax revenue from liquor stores grew by 27.7% from the same time last year across the selected counties in Arkansas while bars in the same areas saw a steep decline of 33.9% in sales tax revenues from last year.

The last three months of reported data, September to November, have shown little change in the general trend. Liquor stores saw their sales tax revenue grow 35.9% among the representative counties in Arkansas on year-over-year basis. Bars experienced declines in sales tax revenue of 29.4% during the same period, driven largely by a slow November which was a busy month in 2019.

The results were consistent across the individual areas for which detailed data was available. The pandemic brought about a drastic decline in tax revenue in total tax revenue from bars and an increase in tax revenue from liquor stores between March and November but some areas showed improvements in bar sales tax collection as the year progressed. The bars in Little Rock, Northwest Arkansas and Pine Bluff continued to struggle in the latter part of the year (September to November). Meanwhile, the bars in Fort Smith, Hot Springs and Carroll County experienced fluctuations of growth and declines.

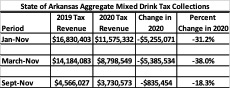

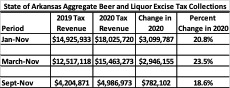

An examination of aggregate tax collections for Arkansas also demonstrates similar trends that we have observed from the industry tax data. The aggregated mixed drink tax collections from restaurants, bars and clubs have declined 38.0% during the pandemic (March to November), and declined 18.3% during the Fall (September to November), on year-over-year terms. In the same periods, the alcoholic excise tax revenue collected from wholesalers increased by 23.5% and 18.6%, respectively on a year-over-year basis. The trend during COVID is clear, it’s been a bad time for businesses providing on-site alcoholic consumption and a good time for retailers of alcohol to be consumed off-premises.

Alcohol Consumption Patterns

The change in business outcomes for bars and liquor stores raises a few basic questions. The most notable one is: Does the data provide any insights into changes in alcohol consumption?

A comparison of aggregate tax revenue for the same period in 2019 and 2020, March to November, provides some straightforward answers. While bars have struggled during COVID-19, it does not appear to be a result of declining alcohol consumption.

The size of tax revenue collected from liquor stores dwarfs the collections from bars. In 2019, liquor stores, across the selected counties in Arkansas, generated tax revenue which was 4.5 magnitudes larger than the tax revenue generated by bars. The pandemic has seen this ratio grow to 8.8 in 2020. The drastic increase in liquor store traffic appears to be caused by consumers shifting away from frequenting bars and a separate increase in at-home alcohol consumption.

The Road Forward

Bars across the state provide an important social and cultural function but have been hard hit by the COVID-19 pandemic. Some funds have been made available to small businesses, such as bars, in the latter part of 2020. The state of Arkansas awarded $48 million in grants to help 2,136 businesses who were impacted by COVID and filed applications in November. The passage of the new COVID-19 Relief Bill in December provides some new assistance to bars and other small businesses, specifically the $284 billion allocated to fund another round of forgivable Paycheck Protect Program loans.

However, these funds alone will not be enough to ensure the survival of bars in Arkansas. Additional direct grants for bars will be needed to defray the accumulated fixed costs like rent. The help is essential as these small business will continue to deal with declining revenues and increasing costs, largely associated with safety and protective equipment.

The distribution of COVID vaccines will over time increase public confidence in the safety of returning to bars, but without additional immediate support there may not be many bars to return to.

A Quick Review of COVID and the Business Environment

The reports provide us with the information to compare how COVID has impacted two different subindustries that offer the same product – bars and liquor stores. The first presumptive case of COVID in Arkansas was seen in Pine Bluff on March 11, 2020. As confirmed cases rose in the following week, Governor Hutchinson acted to close public schools and limit restaurants and bars to carryout, curbside pickup or delivery. The Arkansas Alcoholic Beverage Control adopted an emergency rule to allow the sale of alcoholic beverages with outbound food orders. Regardless, the measures left many businesses to pivot to the new realities of COVID in a short period.

As COVID numbers initially began to decline in late April, the governor announced plans to begin re-opening sectors of the economy. Phase 1 guideline would allow restaurants to provide dine-in services at one-third capacity if certain safety conditions were enforced; however, bar-areas of restaurants and bars were not allowed to re-open under the plan. The restrictions forced many restaurants, bars and breweries to pivot in order to survive.

Late May saw bars reopen at two-thirds capacity while restaurants were allowed to expand to two-thirds of their dine-in capacity. The implementation of open container zones have been an option utilized by several Arkansas cities during the pandemic. In 2019, the State Legislature passed Act 812 which allows cities to create zones permitting open containers of alcohol. Open-drink zones were adopted by the cities of Mountain Home, El Dorado and Little Rock during July and August 2019. The cities of Fayetteville, Springdale and Fort Smith have adopted these zones to aid restaurants and bars in ensuring social distancing guidelines.

The persistence of COVID-19 resulted in Governor Hutchinson enacting an 11 p.m. curfew for businesses that sell or serve alcohol on their premises. The directive came into effect on Nov. 20, 2020, and was in effect through Jan. 3, 2021. Asides from the curfew, liquor stores had mainly been restricted by the safety conditions required of retailers.

The Data

The Arkansas Department of Finance and Administration provides monthly tax report available by city/county and industry. The industry-specific reports are behind by two report (i.e. a March 2020 report will show tax collection for January 2020). The reports serve as a proxy about the general economic and business environment of a city/county and its industries. If tax revenue is up then this suggests a region and/or industry is experiencing growth. The detailed nature of these reports provided a manner to do cross comparisons.

Monthly tax revenue data, by NAICS industry, was retrieved from the Arkansas DFA for the period January 2019 to November 2020. The businesses of focus are bars (NAICS 7442 – drinking establishments) and liquor stores (NAICS 4453 - Beer; Wine; and Liquor Stores). Bars are defined as bars, taverns or drinking places who primarily prepare and serve alcoholic beverages and may provide limited food services. Liquor stores as primarily engaged in retailing packaged alcoholic beverages, such as beer, wine and liquor.

Tax revenue data, as defined by the specific NAICS industry codes of interest, for 2019 and 2020 was available for seven counties in Arkansas. The available counties mirrored the metropolitan statistical areas in Arkansas. For this reason, our analysis will reference six distinct areas. The distinct areas are defined as: Fort Smith (Sebastian), Hot Springs (Garland), Little Rock (Pulaski), Northwest Arkansas (Benton, Washington), Pine Bluff (Jefferson) and Carroll County. Texarkana (Miller) also had tax revenue data but was excluded due to an apparent change in reporting in the middle of the period which prevented year-by-year comparisons.

The absence of data for most Arkansas counties will be supplemented by insights from the state-level tax revenue reports for the different alcohol taxes in Arkansas. Arkansas provides monthly updates for the 4% Additional Mixed Drink Tax, the Beer Exercise Tax, Liquor Tax Collection, and Mixed Drink Tax Collection. The Arkansas Legislative Tax Handbook of 2018 provides the definitions of these different taxes.

The mixed drink tax is a 14% gross sales tax applied to the sale of alcoholic beverages other than beer or native wine which are consumed on-premises. The 4% additional mixed drink tax is levied only on private clubs for the privilege of serving mixed drinks, on top of the mixed drink tax. The mixed drink sales tax is collected from restaurants, bars and clubs. The beer excise tax and liquor tax are collected by the wholesaler based on specific volumes by type of alcohol.

The mixed drink taxes provide clear insight into the state of bars and clubs in Arkansas during COVID. The liquor and beer taxes are more ambiguous as they impact wholesalers who sell to bars, nightclubs and retailers. The inability to separate the different sales channels for beer and liquor means that we will match this data to the trends of the MSAs for insights about liquor stores.