COVID-19 Economic Impact in Arkansas

March 24, 2020 | By Mervin Jebaraj

Jump to impacts: Northwest Arkansas / Central Arkansas / Northeast Arkansas / River Valley

Like the rest of the nation, the state of Arkansas has put into place various measures to contain the spread of COVID-19 and prevent it from overwhelming healthcare systems in the state.

Arkansas residents have been strongly encouraged to practice social distancing, avoid gathering in groups of more than 10 people, go out in public only minimally, and work remotely where possible.

Businesses like restaurants and bars have been limited to take-out or delivery, personal care services and gyms have been closed, and while some hotels remain open for the time being, others have closed or cater to very limited guests.

While these measures are important to slow the spread of the virus, they have immediate economic impacts on businesses across the state of Arkansas.

Small businesses, especially those that operate in the leisure and hospitality, personal care, and recreation industries have limited margins or capital to cover fixed costs while being closed or having customer traffic reduced dramatically.

With uncertainty over how long some of these measures will be in place, small businesses in these industries may permanently close, prolonging the path to recovery from this temporary economic crisis.

It is imperative that federal, state, and local elected officials put together a package of grants and loans to help these businesses survive the temporary closures and loss of customers.

Additionally, employment in the leisure and hospitality industries has been an area of strength for the Arkansas economy over the past decade, and the permanent closure of these businesses would leave a lot of Arkansans unemployed.

Over the week, researchers from the Center for Business and Economic Research in the Sam M. Walton College at the University of Arkansas are going to provide some quick estimates for cities across Arkansas on the loss of sales, sales taxes, and overall employment and economic impacts for these industries.

The analysis covers the restaurant and food service industry, bars and clubs, gyms and other recreation services, and personal care services.

The following assumptions were used to model the impacts on sales for these business sectors:

- Most of the measures put in place to contain the spread of COVID-19 were implemented in mid-March. We assume that they will remain in effect in April and May and be gradually scaled back in June.

- Restaurants and food service sales were reduced by 50% March and June and by 80% in April and May (However, at limited service restaurants like drive-throughs, we assume sales are reduced by 20% in March and June and by 30% in April and May, respectively).

- Sales at bars and clubs were reduced by 50% in March and June and by 90% in April and May.

- Sales at hotels and other accommodations, and personal care services were also reduced to 50% for March and June, while sales in April and May were reduced by 80%.

- Gyms, health clubs and other recreation had sales reduced by 50% in March and June and were set to zero sales for April and May to account for closures.

- Sales estimates in these cities were based on 2019 sales tax collections gathered from the Arkansas Department of Finance and Administration, which we realize is underestimating the potential sales for the year 2020

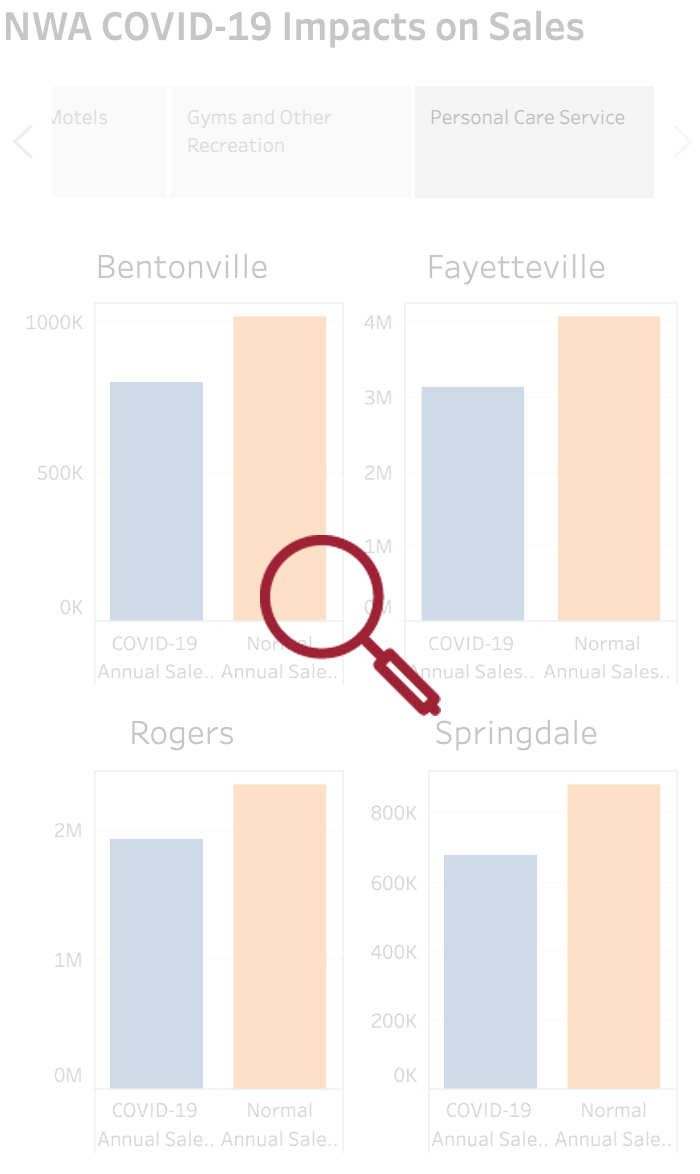

Impacts of COVID-19 on Northwest Arkansas Cities

- The sales from the leisure and hospitality, recreation, and personal care services industries in the four main cities in Northwest Arkansas (Bentonville, Fayetteville, Rogers and Springdale) are estimated to decline by 19.3 percent in 2020 as a result of COVID-19 measures when compared to what might have been a year where sales were similar to 2019.

- 2020 sales from these industries are expected to decline by $202.2 million in the four cities and sales tax collections from these industries are expected to decline by $4.0 million.

- Restaurant and food service sales account for 74.4 percent of the decline in sales or about $150.5 million. Fayetteville accounts for $54.6 million of the lost sales from the restaurant sector, followed by Rogers with $43.7 million.

- Hotels and other traveler accommodations account for 18.1 percent of the overall lost sales or $36.5 million in the four cities in Northwest Arkansas. The losses in the hotel sector total $10.1 million in Bentonville, $10.5 million in Fayetteville, and nearly $10.9 million in Rogers.

- Sales at gyms and other recreation services are expected to decline by $9.4 million in 2020.

- Bar and club sales are expected to decline by $4.0 million across the four cities with nearly half the loss accounted for by bars and clubs in Fayetteville.

- Personal care services can expect to see a decline of $1.7 million in sales.

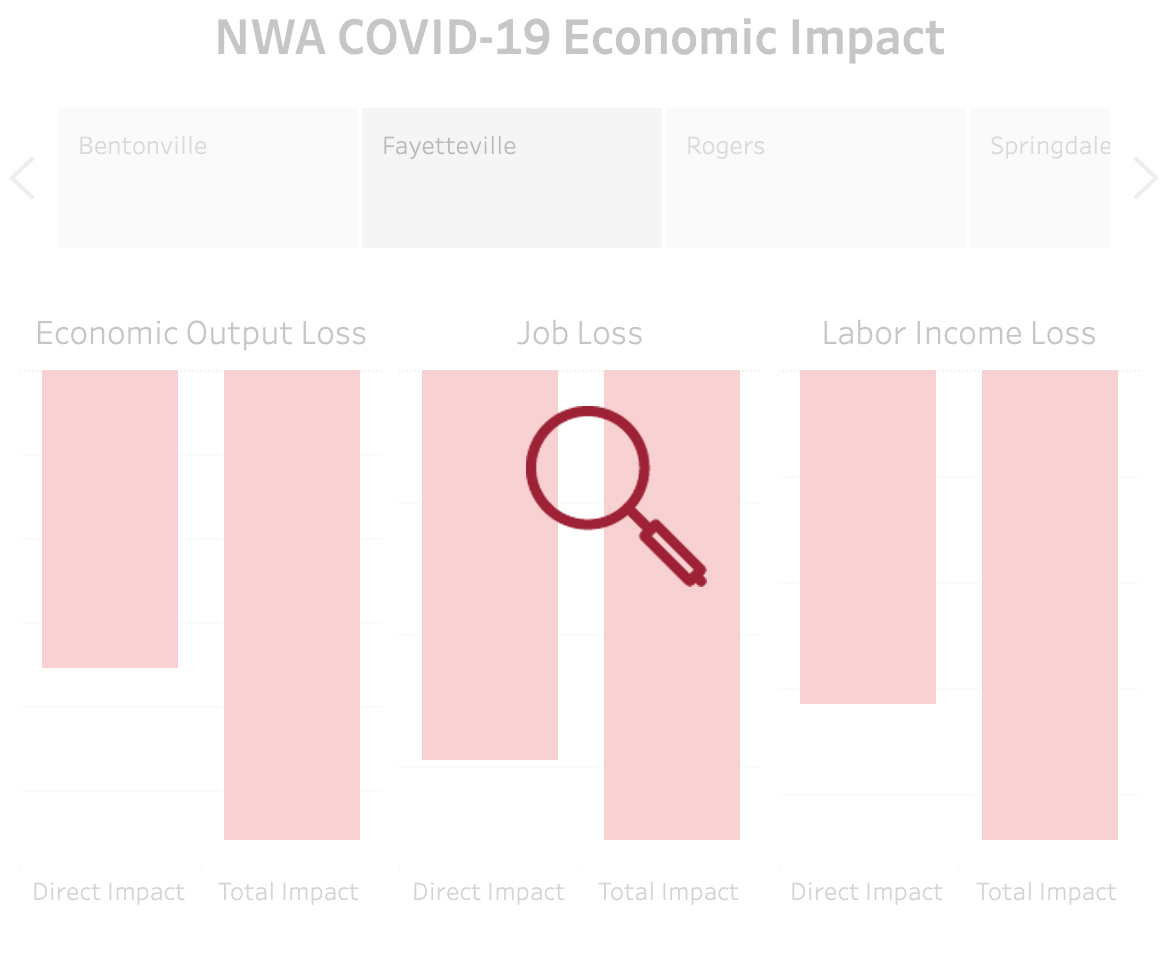

Economic Impact of COVID-19 on Northwest Arkansas Cities

The loss of sales (as measured above) were modeled in IMPLAN to provide estimates of the size of job losses, lost labor income, and the lost economic output.

The model provides two estimates of losses: direct losses and total losses. Direct losses enumerate the job losses, labor income losses, and economic output lost from the leisure and hospitality, recreation, and personal care services industries directly affected by the shutdown. Total losses include direct losses, the losses that occur throughout the supply chain of these industries, and the loss in spending power of employees that are directly affected and those in the supply chain.

- Across the four main cities in Northwest Arkansas, we expect to see nearly 5,000 jobs lost from the closures in the leisure and hospitality, recreation, and personal care services industries.

- Fayetteville and Rogers will experience the largest employment losses.

- The restaurant and bar industries alone account for more than 3,000 of the lost jobs.

- Total labor income losses are estimated at $122.7 million.

Bentonville: The total loss in economic output from the COVID-19 measures is estimated to be $55.5 million. 872 jobs will be lost in total and the associated labor income loss is estimated to be $22.0 million. Jobs lost from the directly affected industries add up to 753 and their associated labor income loss is estimated to be $16.6 million. Of the jobs lost in Bentonville, nearly 600 came from the restaurant and bar industries.

Fayetteville: The total loss in economic output from the COVID-19 measures is estimated to be $112.1 million. 1,784 jobs will be lost in total and the associated labor income loss is estimated to be $44.4 million. Jobs lost from the directly affected industries add up to 1,478 and their associated labor income loss is estimated to be $71.1 million. Of the jobs lost in Fayetteville, more than 1,200 came from the restaurant and bar industries.

Rogers: The total loss in economic output from the COVID-19 measures is estimated to be $86.5 million. 1,421 jobs will be lost in total and the associated labor income loss is estimated to be $35.5 million. Jobs lost from the directly affected industries add up to 1,237 and their associated labor income loss is estimated to be $27.0 million. Of the jobs lost in Rogers, more than 1,000 came from the restaurant and bar industries.

Springdale: The total loss in economic output from the COVID-19 measures is estimated to be $51.5 million. 828 jobs will be lost in total and the associated labor income loss is estimated to be $20.7 million. Jobs lost from the directly affected industries add up to 686 and their associated labor income loss is estimated to be $14.8 million. Of the jobs lost in Springdale, around 600 came from the restaurant and bar industries.

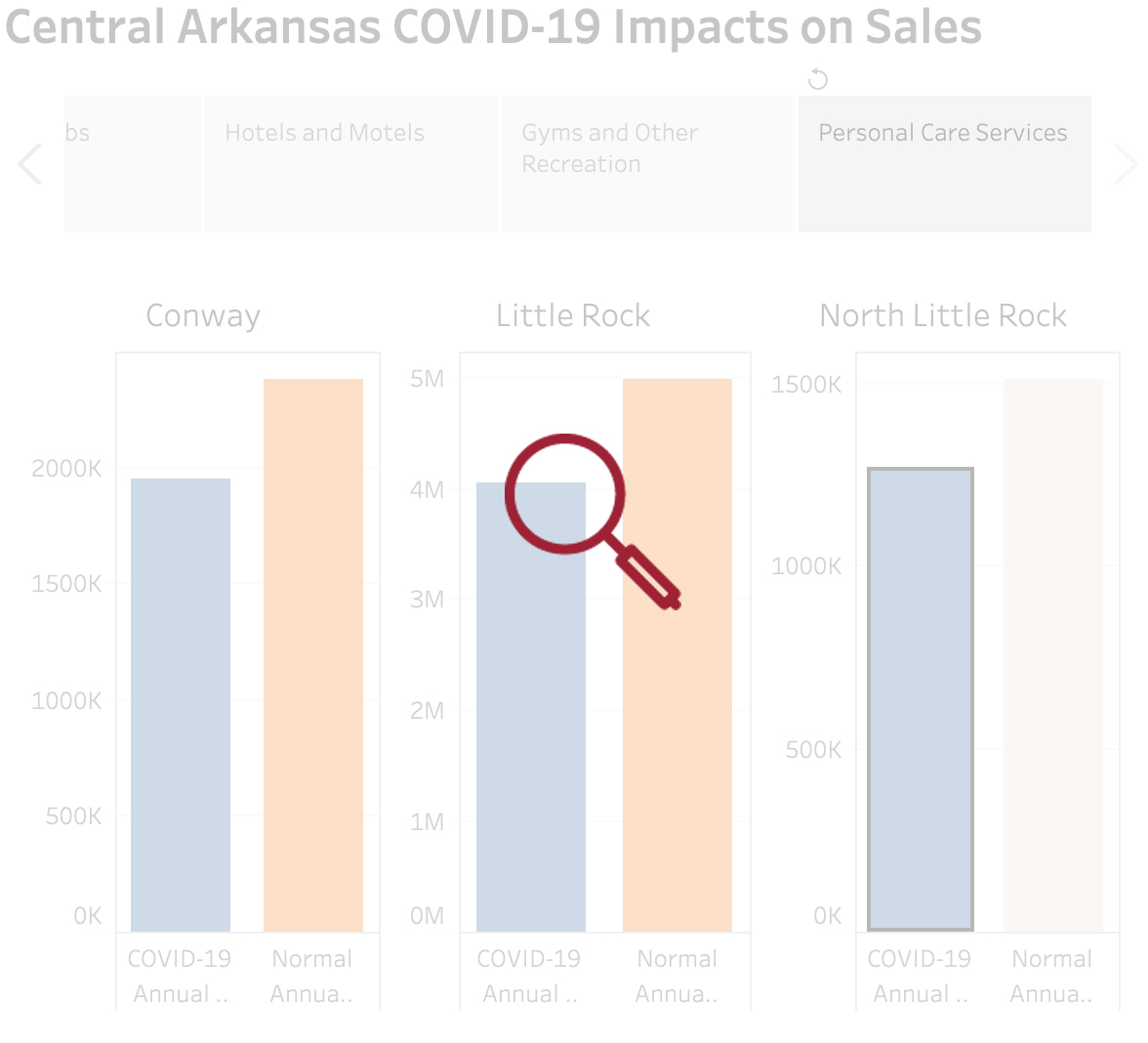

Impacts of COVID-19 on Central Arkansas Cities

- The sales from the leisure and hospitality, recreation, and personal care services industries in the three main cities in Central Arkansas (Little Rock, North Little Rock, and Conway) are estimated to decline by $245.7 million in 2020 as a result of COVID-19 measures when compared to what might have been a year where sales were similar to 2019.

- 2020 sales from these industries are expected to decline by 20.4 percent in the three cities and sales tax collections from these industries are expected to decline by $4.1 million.

- Restaurant and food service sales account for 72.8 percent of the decline in sales or about $178.8 million. Little Rock accounts for $111.3 million of the lost sales from the restaurant sector, followed by North Little Rock with $40.2 million.

- Hotels and other traveler accommodations account for 18.4 percent of the overall lost sales or $45.2 million in the three cities in Central Arkansas. The losses in the hotel sector are heavily concentrated in the city of Little Rock accounting for about $33.6 million in losses.

- Sales at gyms and other recreation services are expected to decline by $13.6 million in 2020.

- Bar and club sales are expected to decline by $6.4 million across the four cities with most of the losses occurring in Little Rock.

- Personal care services can expect to see a decline of $1.6 million in sales.

Impacts of COVID-19 on Northeast Arkansas

- The sales from the leisure and hospitality, recreation, and personal care services industries in Jonesboro in Northeast Arkansas are estimated to decline by nearly $40.0 million in 2020 as a result of COVID-19 measures when compared to what might have been a year where sales were similar to 2019.

- 2020 sales from these industries are expected to decline by 19.7 percent in the Jonesboro and sales tax collections from these industries are expected to decline by nearly $400,000.

- Restaurant and food service sales account for 82.0 percent of the decline in sales or about $32.6 million.

- Hotels and other traveler accommodations account for 11.2 percent of the overall lost sales or $4.4 million in Jonesboro.

- Sales at gyms and other recreation services are expected to decline by $2.2 million in 2020 and sales at personal care services can expect to see a decline of $0.5 million.

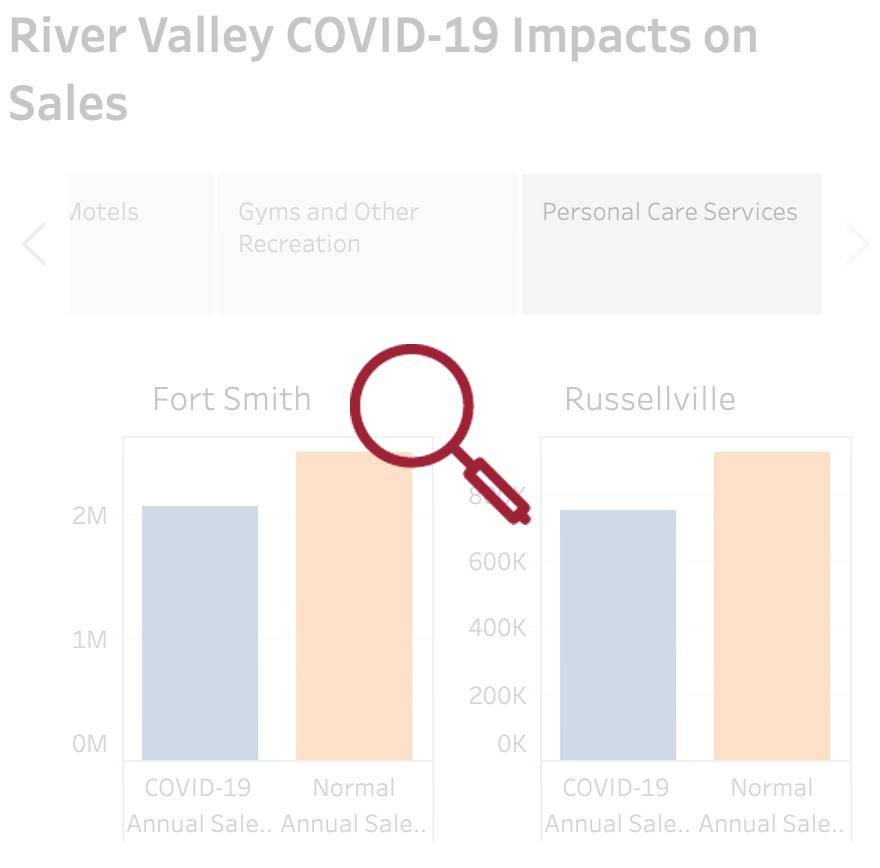

Impacts of COVID-19 on River Valley Cities

- The sales from the leisure and hospitality, recreation, and personal care services industries in the two main cities in the River Valley region (Fort Smith and Russellville) are estimated to decline by $77.7 million in 2020 as a result of COVID-19 measures when compared to what might have been a year where sales were similar to 2019.

- 2020 sales from these industries are expected to decline by 20.4 percent in the two cities and sales tax collections from these industries are expected to decline by $1.5 million.

- Restaurant and food service sales account for 81.2 percent of the decline in sales or about $63.1 million. Fort Smith accounts for $47.3 million of the lost sales from the restaurant sector, followed by Russellville with $15.8 million.

- Hotels and other traveler accommodations account for 11.2 percent of the overall lost sales or $8.7 million in Fort Smith and Russellville. The losses in the hotel sector are heavily concentrated in the city of Fort Smith accounting for about $6.3 million in losses.

- Sales at gyms and other recreation services are expected to decline by $2.8 million in 2020.

- Bar and club sales are expected to decline by $2.5 million in the city of Fort Smith.

- Personal care services can expect to see a decline of about $620,000 in sales.

Brenna Frandson, a student research assistant at the Center for Business and Economic Research, contributed

analysis for this report