Recent data from the World Bank shows how Russia’s invasion of Ukraine is impacting energy prices and, by extension, prices for other commodities.

Energy

While European leaders have sanctioned many Russian exports, most have hesitated to restrict the flow of oil and natural gas from the country that provides 25% of the European Union’s oil and 40% of its gas. But even as most of Russia’s European customers decided they had no choice but to continue buying its oil and natural gas — at least for the time being — prices rose considerably as the U.S., U.K., Canada, and Australia announced sanctions.

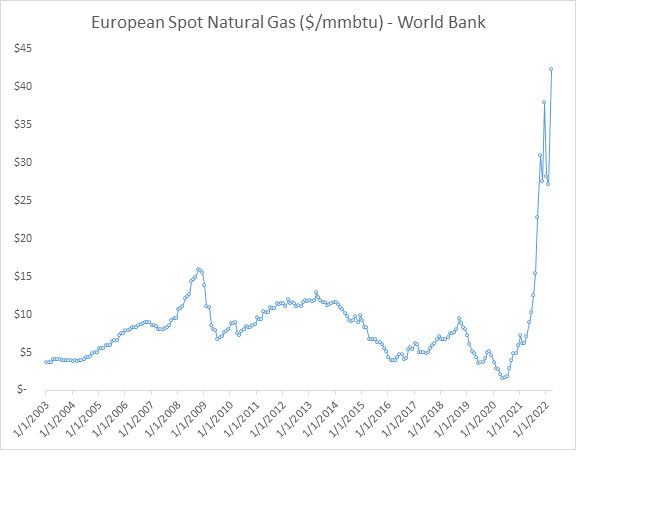

European natural gas spot prices rose 56% from February to March, up 592% from a year ago per data from the World Bank. In comparison, natural gas prices in the U.S. rose 5% from February to March and are up 90% year-over-year; the respective statistics for natural gas in Japan are 6% and 128%. Thus, the Russia-Ukraine conflict has placed European plants at an energy cost disadvantage relative to those in the U.S. or East Asia.

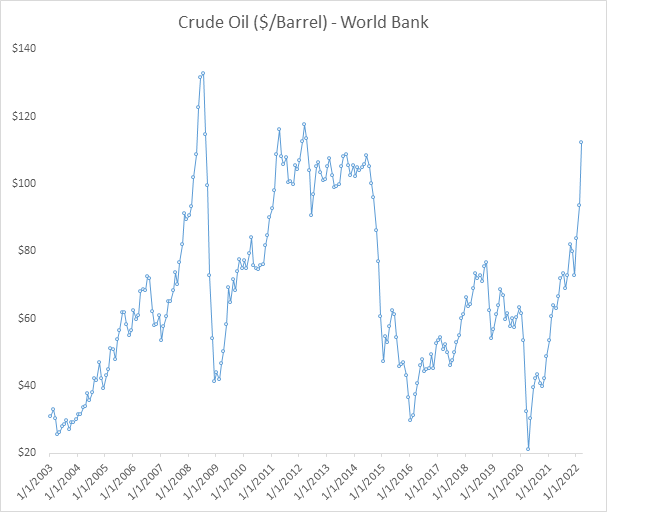

The conflict also helped raise global oil prices 20% in March, as crude oil hit $112 per barrel.

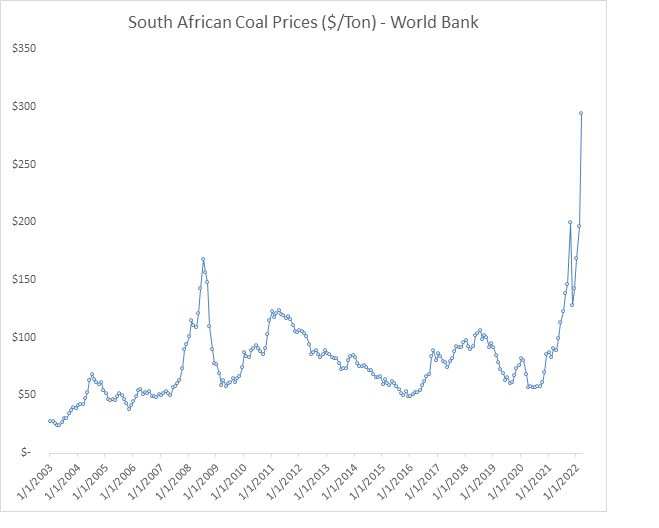

Rising oil and natural gas prices helped create a spike in demand for coal, a much-maligned fuel that many nations have recently tried to move away from. Amidst speculation that European Union nations would soon sanction Russian coal, South African coal prices rose 50% in March. We focus on South African pricing data because it is both available from the World Bank and South Africa’s geographic position means that it can serve as a potential alternative coal supplier for Europe now the EU has announced that it will be banning Russian coal in August. However, the extent South Africa exports of coal to Europe will increase is uncertain because most South African coal is exported to South Asia.

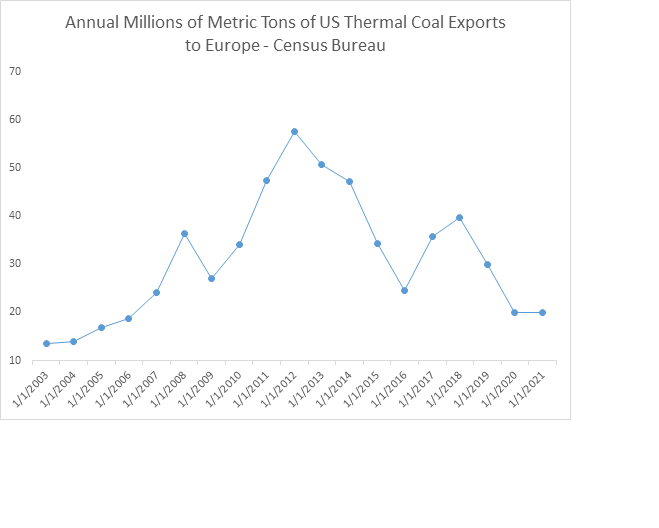

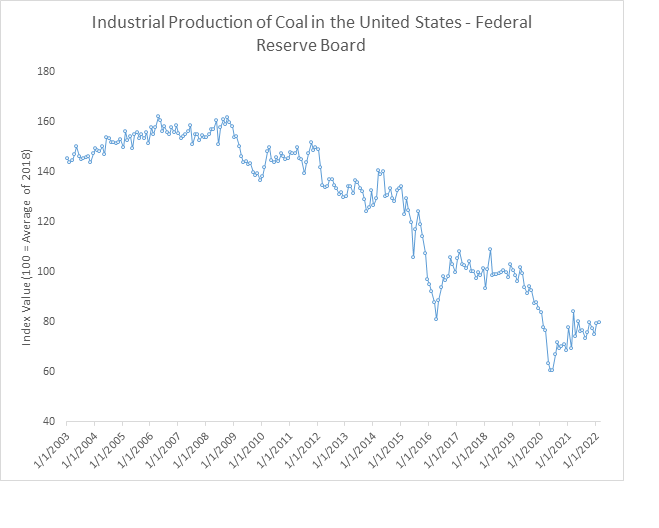

While the United States is also geographically positioned to supply coal to Europe, Census Bureau export data indicates that in 2021 the U.S. exported 19.9 million metric tons of coal to Europe, well below the peak of 57.7 million metric tons exported in 2012. Furthermore, data from the Federal Reserve Board indicates coal production in the United States slid sharply over the past few years, with output in the fourth quarter of 2021 being down 23% from the fourth quarter of 2018 (and output in the fourth quarter of 2018 was itself down 24% from output in the fourth quarter of 2012, the year of record European exports). Thus, it seems highly unlikely that U.S. coal mines will be able to increase output quickly enough to balance supply and demand.

Other Markets

Energy price increases ripple through all commodity markets and supply chains to varying degrees since they impact transportation and manufacturing costs. Rising oil and natural gas costs mean that inflation will not go away anytime soon and may worsen. It be several months before many energy-related costs — such as the electricity-intensive manufacturing of aluminum — are felt by consumers, as it typically takes manufacturers multiple months to pass on higher input costs to wholesalers and retailers.

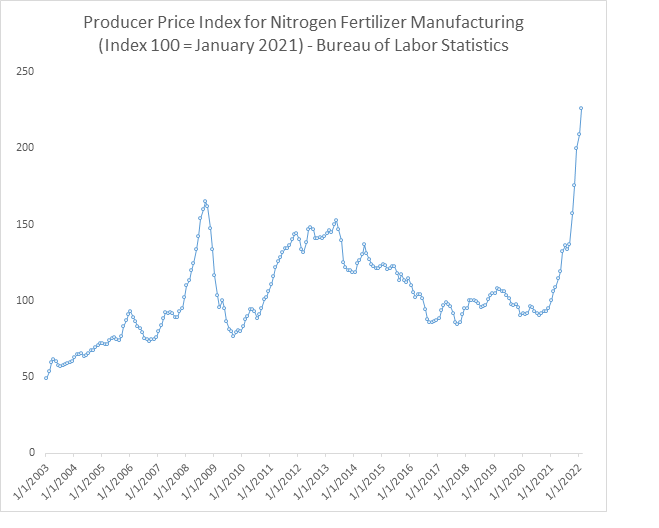

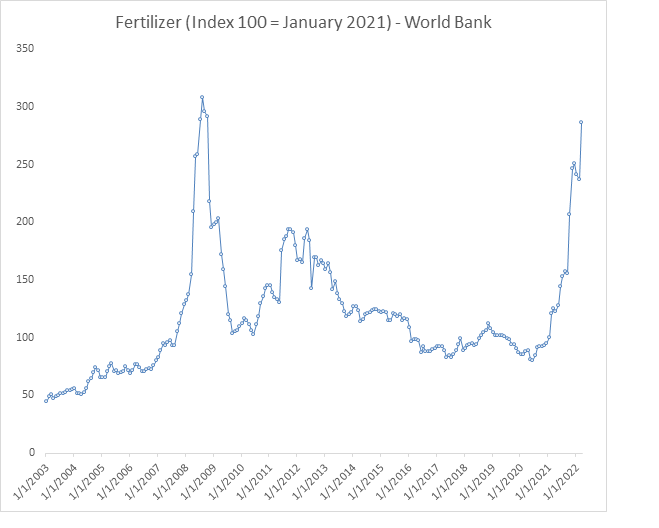

One example of energy prices' potential ripple effects involves food security. In early March, the World Bank warned that high energy prices could further inflate food costs and spark riots like those seen in dozens of countries during the Great Recession. Natural gas is a key component of nitrogen fertilizers, so rising gas prices contributed to a 21% uptick in fertilizer prices by the end of March, pushing prices just short of their Great Recession peak in the World Bank’s data.

Data from the Bureau of Labor Statistics concerning the price of domestically produced nitrogen-based fertilizers indicate this commodity category was already experiencing record-high prices as of February 2022. Prices are likely to get even worse.