While mounting trade sanctions against Russia may devastate its economy, the United States and other sanctioning nations will likely be affected indirectly based on how the conflict roils commodity markets. Russia is a relatively minor U.S. trading partner, but the disruption of Russian fertilizer, wheat, and aluminum exports to the U.S. and elsewhere will likely worsen our inflationary woes.

Fertilizer

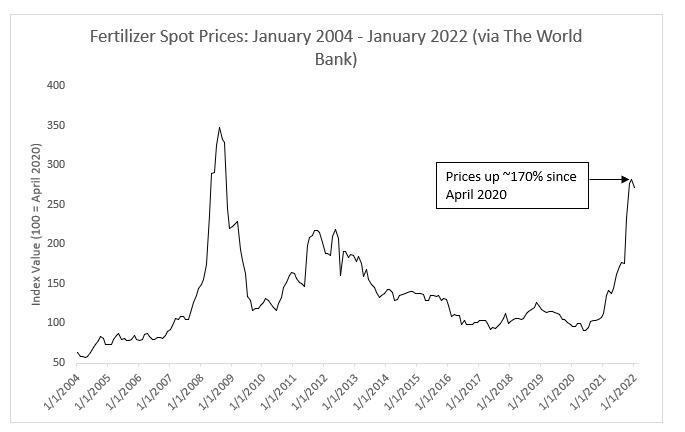

Farmers’ prices for equipment, labor, seeds, chemical weed killers, and fertilizer have risen substantially during the pandemic. Farm input prices eventually affect food prices, so we were already on track to see (even) higher prices in grocery stores and restaurants later this year. The disruption of trade with Russia will exacerbate the problem.

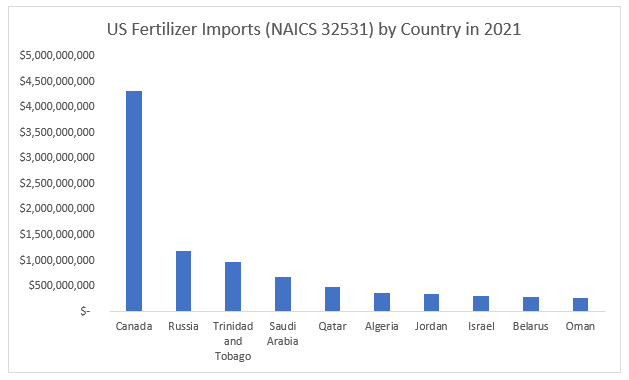

Russia is the world’s second largest fertilizer exporter, behind Canada. It has long provided large quantities of cheap fertilizer to the U.S., to the point that the Biden administration implemented antidumping tariffs ranging from 9% to 47% on Russian phosphates in 2021. Despite the tariffs, Russia remained the second largest exporter of fertilizer to the U.S. and its largest foreign source of nitrogen-based fertilizer based on data from the Census Bureau’s USA Trade Online database.

If sanctions against Russia are eventually expanded to include natural gas, thereby raising worldwide prices, the situation will worsen. Natural gas is a component most nitrogen-based fertilizers — which further helps explain why President Biden and other Western leaders have not targeted Russian fuel exports.

Wheat

Policy reforms implemented after the collapse of the Soviet Union allowed Russia to go from importing wheat from the U.S. and others to becoming the world’s leading wheat exporter by 2016. Ukraine is the seventh largest wheat exporter. Combined, the two warring countries provide approximately 29% of the world’s wheat.

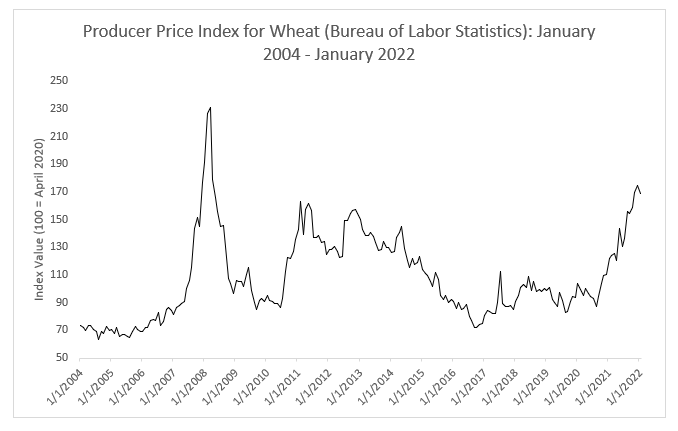

The disrupted flow of wheat from Russia and Ukraine will likely raise American food prices in a more indirect way than we will see with fertilizer. The U.S. does not rely on Russia and Ukraine for wheat, but many Middle Eastern and Asian nations do. The disruption will likely increase global prices for wheat — which have already risen 70% during the pandemic —and other grains.

If Russian forces remain in Ukraine for an extended period and disrupt farmers’ planting schedules, some expect it will take years for grain and seed oil prices to return to normal.

Aluminum

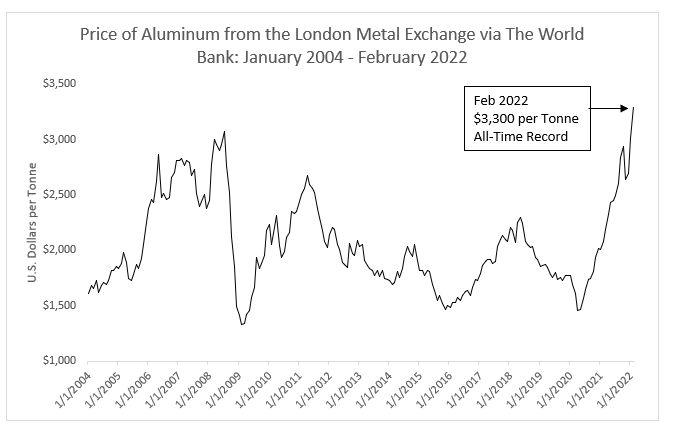

Aluminum prices plummeted during the early weeks of the pandemic due to weak demand in the automotive and aerospace sectors, only to sharply recover and reach record levels by February 2022.

News of Western sanctions against Russia pushed prices on the London Metal Exchange even higher. Russia is the world’s third-largest exporter of aluminum, providing approximately 6% of the global supply of the ubiquitous metal. Though the U.S. imports relatively little Russian aluminum, it seems inevitable that global aluminum prices will continue to rise in coming weeks, worsening our inflation problem.