Retailers spent most of the previous 25 months struggling to keep pace with historic consumer demand. Meeting that demand would have been challenging in the best of times, but the pandemic’s impact on global supply chains and retail inventories made the task downright Herculean.

Unfortunately, just as COVID-19 case numbers have fallen and supply chains have recovered enough for firms to replenish their inventories, it seems retailers may be headed out of the frying pan into the fire.

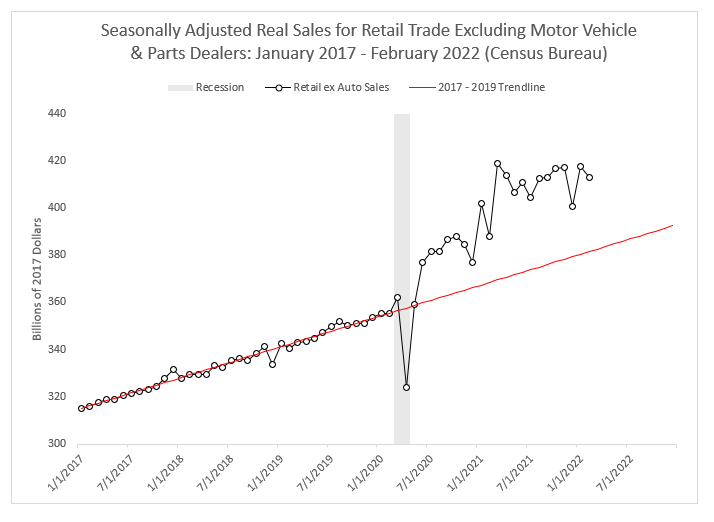

Sales

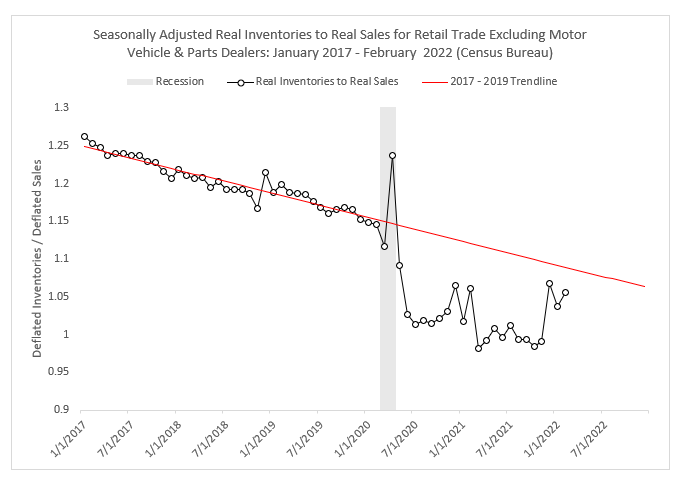

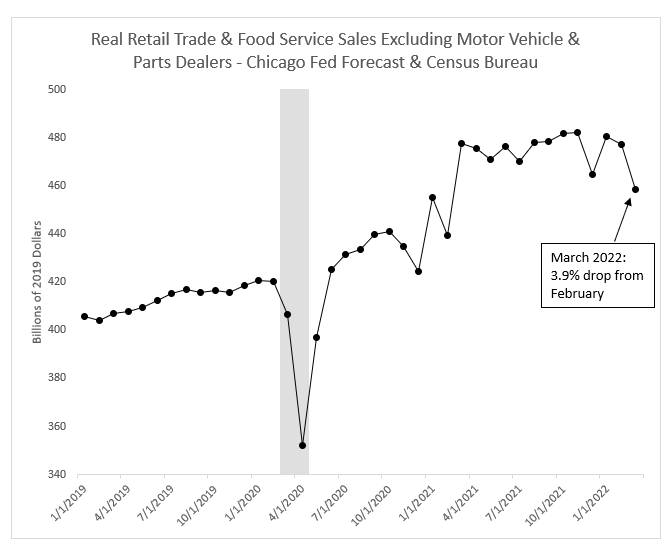

Recent federal economic data suggests that inflation and the resurgence of travel and restaurant dining may be cooling retail demand. Census Bureau data shows that seasonally adjusted retail trade sales excluding motor vehicle & parts dealers dipped slightly in February, though they remained well above the pre-COVID trendline.

However, the Federal Reserve Bank of Chicago’s forecast for this sector of retail (combined with food services) expects an even sharper drop for March, suggesting that February’s disappointing sales may not have been a blip on the radar, but the start of a downward trend.

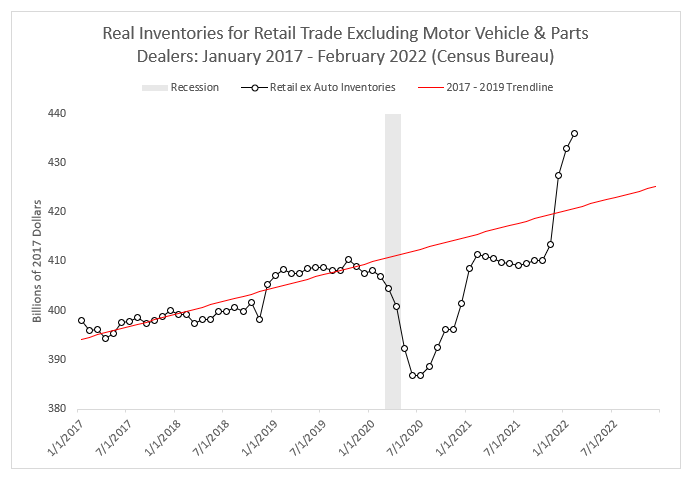

Inventory Levels

Declining sales are never good news, but they are particularly undesireable when inventory levels are simultaneously increasing. Census Bureau data shows that inventory levels have stayed well below 2019 levels through most of the pandemic and did not recover until very recently. If sales continue falling, then retailers’ newly replenished inventories — which would have been an asset had sales remained at 2021 levels — could prove to be a burden that ties up working capital and erodes profitability.